Olive Tree Charitable Trust

Purpose and History of the Trust

The Olive Tree Charitable Trust was established in 1991 with aims to acquire land, build and administer the operations of a retirement village located at Dalwood Grove in Highbury. In 2008 the village and villas from the owner-residents were sold.

The funds from the sale of the village infrastructure and common facilities enabled the Trust to establish a diversified investment portfolio, the annual income from which enables the Trust to provide grants, donations, and funding to a wide range of organisations to help fund projects that benefit the residents within our local community and region.

Contact Us

Downloads

OTT Funding Guidelines (February 2025)

PDF - 474 KB

OTT Accountability Report Guidelines (February 2025)

PDF - 401 KB

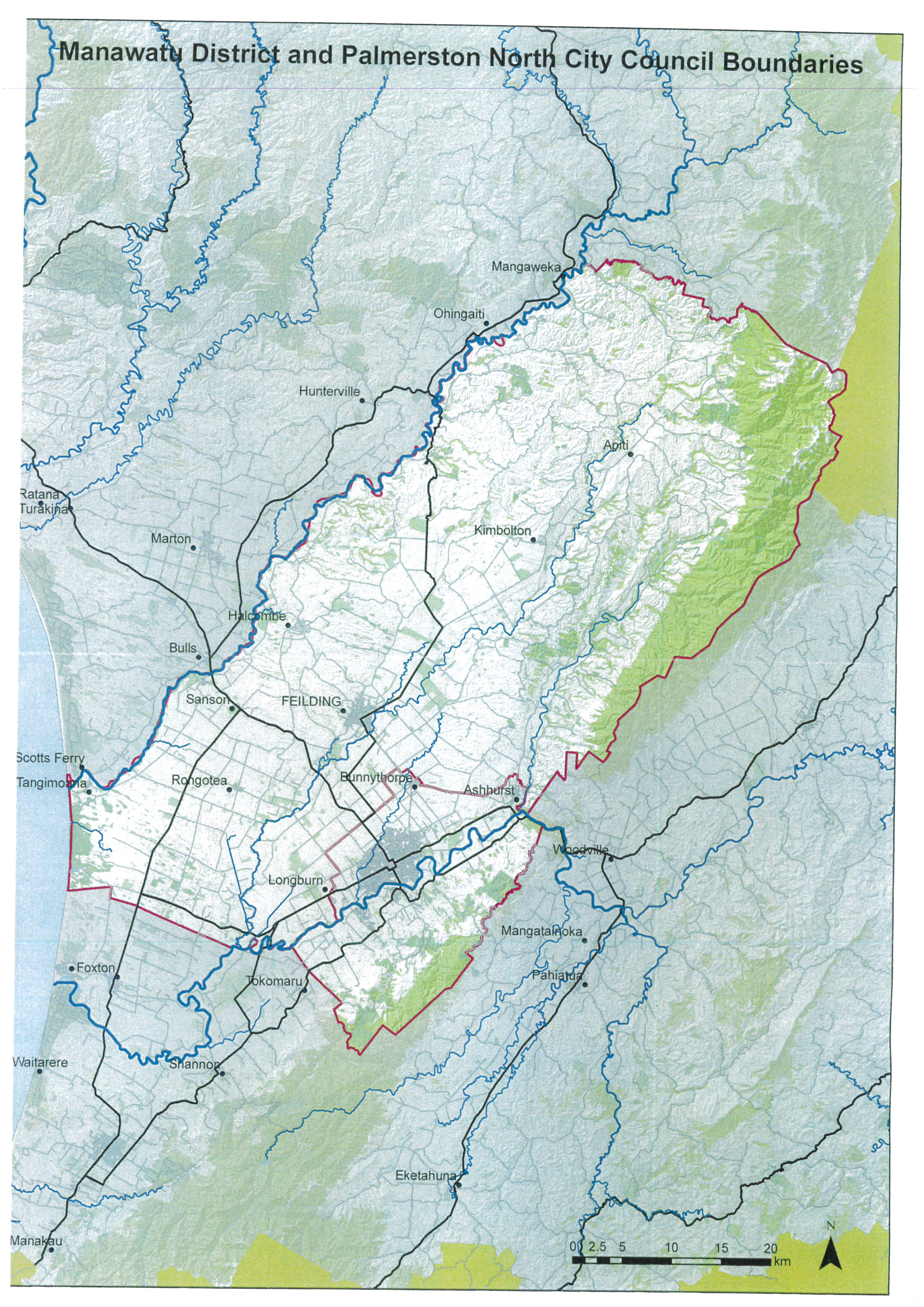

Regional Map